Federal student loan payments have been paused and interest rates set to 0% since March of 2020. Though the most recent pause is set to expire at the end of August, the federal government has instructed student loan servicers to wait on initiating the repayment process. Many take this as a sign that another extension is in the works.

For months now, the White House has been signaling an interest in forgiving 10k for all borrowers who make less than $125,000-150,000 per year. But with so many extensions over the last few years, and with many progressives pushing for much broader cancellation, many Americans are wondering why student loan debt forgiveness isn’t just the federal government’s next step. After all, with little to no payment collections happening since early 2020, cancellation doesn’t seem that problematic, right? Once we reach that August 2022 deadline, payments and interest will have been paused for nearly two-and-a-half years.

Here, we’re taking a look at why making the suspension functionally permanent by canceling student debt could be a wise move.

The Case for Canceling Student Loan Debt

The Economic Benefits of Student Loan Cancellation

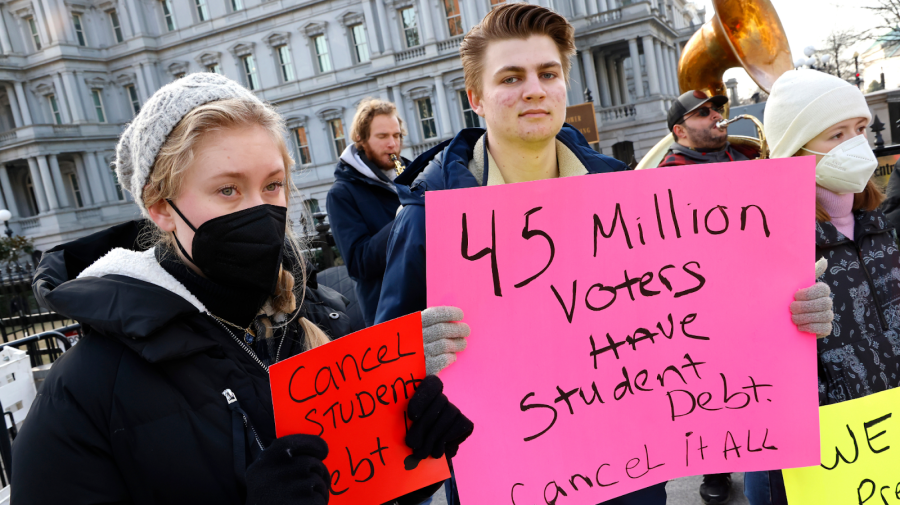

Americans have approximately $1.75 trillion in student debt, spread across about 45 million borrowers. (Some estimates put that number closer to 46 million.) That burden has a notable impact on borrowers — and the broader economy.

Often, payments represent a significant hardship for a household’s budget, even among middle-income households. After all, a sizable, long-term debt limits your choices, making you less likely to buy a home, get married, have children and/or save adequately for retirement. If federal student loans were canceled, a major hurdle to accomplishing these, and other, milestones disappears. For some, that would mean more saving and spending.

Along with potentially acting as a tax cut-style stimulus, the cancellation may help more people launch businesses. Without debt hanging over them, these would-be entrepreneurs and their businesses could strengthen the economy on multiple levels.

Significant debt loads also take a mental and emotional toll on borrowers. Financial stress can trigger many conditions, including depression and anxiety. And considering that inflation has recently reached a 40+ year high, taking an opportunity to reduce Americans’ financial burdens and ease their stress would likely be well-received, especially since a majority of voters support student debt cancellation.

How Student Loan Cancellation Could Impact Gender, Race, and Class Equity

While student loan cancellation is seen first-and-foremost as a financial issue, it’s also an issue of equity. For example, Black households carry more student debt than white households. Additionally, there isn’t necessarily a parity of income among graduates of different races, leaving some minorities behind a critical curve, all while shouldering more debt.

Similarly, women often face a harder financial road than men, even among college graduates. Pay discrimination is one factor, and that’s an issue that typically worsens as women age. Couple that with the fact that women bore a higher career-related burden than men during the COVID-19 pandemic, and the disparity may deepen even further.

While federal student loan cancellation has the ability to help those who may need it most, people from all walks of life can benefit. That, of course, doesn’t preclude minorities from experiencing equitable gains, which is particularly true if income factors into the cancellation equation. Reportedly, the White House is considering limiting student loan forgiveness to borrowers with incomes under $125,000. If this ends up being the path forward, it will target households in need of support the most, including households composed of people of color, Black people and women.

The Impact of Cancellation on the Midterm Elections

While one may hope that student loan forgiveness becoming a reality wouldn’t hinge entirely on political strategy, the reality of the situation is that canceling student debt could help Democrats in the midterm elections. Rising inflation, the toll of the pandemic, and other factors put Democrats at risk as the mid-terms drew near. By canceling student debt before voting begins, Democrats could potentially capitalize on that goodwill — and the fact that a majority of Americans support the decision.

In addition to creating a degree of goodwill, canceling student debt puts Democrats’ opponents in a more difficult position. That is, if Republicans disparage federal student loan cancellation, they’d likely have a significant number of voters disagreeing with such a blunt stance.

Of course, the full impact of student debt cancellation on how voters react at the polls wouldn’t be known until Election Day — if the relief is provided — but early indications suggest it would make a difference. One poll found that providing just $10,000 in forgiveness — the amount President Joe Biden floated while campaigning — would push 45 percent of battleground-state respondents to be more likely to vote, which, in turn, could help Democrats gain an edge over their opponents.

The Argument Against Student Loan Debt Cancellation

While the potential for positive outcomes is certainly there, it’s crucial to understand the arguments against student loan cancellation, too. One of the main points the opposition focuses on is that canceling student loan debt would largely benefit higher-income, white households. It’s noteworthy that the NAACP disagrees.

Some argue that most of the people this kind of relief would help don’t actually need the support, as they’re the ones more likely to successfully repay their debt. While setting an income limit may be one way to satisfy those people who hold this belief, it’s worth noting that this belief is mostly false. In fact, 40% of student debt holders never even finished their degree. And even for those who did, the astronomic rise in cost of living relative to the modest rise in incomes has left many struggling with debt, even those who have landed decent jobs.

Concerns about a “moral hazard” and so-called “fairness” are also part of the equation. “You risk, somehow, creating a moral hazard, meaning that perhaps future students who didn’t benefit from the debt forgiveness today would expect debt forgiveness in the future,” Moody’s Investor Services BP and senior credit officer William Foster says. “They would then, as a result, not worry as much about the debt they’re taking out, because they’re expecting it to be forgiven in the future.”

Some also worry that those who paid off their student loans recently — in a relative sense — may feel slighted that others managed to “sidestep” that responsibility. In this case, it’s an issue of perceived fairness, particularly among those who sacrificed to ensure they could handle their student debt.

And then there’s also the fact that private student loans aren’t covered by this kind of debt cancellation. Ultimately, the government could only act on federal student loans, leaving those who refinanced with private lenders, supplemented federal aid with private loans, or didn’t qualify for federal loans and only used funds from private companies left out. As a result, some loans would remain in place, burdening borrowers.

Ultimately, sweeping moves like student loan forgiveness do come with both potential benefits and drawbacks. In the end, those that are most important to you boil down, largely, to a matter of personal perspective. However, if you are thus creating a contentious atmosphere around federal student loan debt cancellation until President Biden makes a move — or chooses not to do so.